Table Of Contents

- Trade Forex with Multipliers

- Key features and offerings of Deriv.com include

- What Is Multipliers

- Here’s a breakdown of how multipliers work:

- Key features of Multipliers include:

- Now, let’s delve into the specific features of Multipliers.

- Moving on to other features, we have the “Take Profit” option

- Stop Loss Feature

- Next, we have the “Deal Cancellation” feature

- Here’s a summary of how the Deal Cancellation works:

- Review and Confirm:

- Monitor the Trade:

- Conclusion

- Create a Demo Account

Click on the Table of Contents to navigate.

Trade Forex with Multipliers

What Is Deriv?

Deriv.com is an online trading platform that offers a range of financial trading products and services. It provides access to various financial markets, including forex (foreign exchange), commodities, stock indices, and cryptocurrencies, allowing traders to speculate on the price movements of these assets.

Deriv.com, formerly known as Binary.com, is owned and operated by the Binary Group Ltd, a company that was established in 1999. The platform is regulated in multiple jurisdictions, offering a secure and transparent trading environment for its users.

Key features and offerings of Deriv.com include

Trading Instruments: Deriv.com offers a diverse selection of trading instruments, including currency pairs, commodities like gold and oil, stock indices from around the world, and popular cryptocurrencies.

Binary Options and Multipliers: Traders can engage in binary options trading, where they predict whether the price of an asset will go up or down within a specified time frame. Additionally, the platform offers “multipliers,” a product that combines leverage trading and limited risk elements.

SmartTrader and DMT5: The platform provides different trading interfaces, such as SmartTrader, which is user-friendly and suitable for beginner traders, and DMT5 (Deriv MetaTrader 5), a more advanced platform favoured by experienced traders for its comprehensive charting and analysis tools.

Demo Accounts: Deriv.com offers demo accounts for traders to practice and familiarize themselves with the platform before using real money.

Regulation and Security: Deriv.com is licensed and regulated by several financial authorities, providing a level of trust and security for traders.

Education and Support: The platform offers educational resources, video tutorials, and customer support to assist traders in understanding the trading process and using the platform effectively.

It’s essential to note that financial markets and trading platforms can change over time. To get the most up-to-date information about Deriv.com’s services, features, and offerings, I recommend visiting the official Deriv.com website or contacting their customer support directly.

What Is Multipliers

Today, we’re going to provide you with a brief overview of a brand-new product called “Multipliers.”

“Multipliers” is an innovative new product designed to enhance productivity and efficiency for individuals and businesses. The main concept behind Multipliers revolves around a set of tools and methodologies that empower users to achieve more with the same resources, thereby multiplying their output.

Multipliers refer to a specific financial trading instrument that combines elements of both leverage trading and options trading. They are designed to offer traders the opportunity to amplify their potential profits while limiting their potential losses.

Here’s a breakdown of how multipliers work:

- The upside of Leverage Trading: Like traditional leverage trading, multipliers allow traders to control a larger position in the market with a smaller amount of capital. For example, if you want to trade a position worth $1,000, you may only need to stake a fraction of that amount, say $100, with a multiplier of 10x. This leverage amplifies the gains based on the total position size, allowing traders to potentially earn higher profits compared to a standard trade.

- Limited Risk of Options: In options trading, the risk is limited to the premium paid for the option. Similarly, with multipliers, the potential losses are capped at the stake amount. If the market moves against your prediction, you can only lose the amount you staked, regardless of the extent of the market’s movement.

- Profit Multiplication: When the market moves in the direction you predicted, you can potentially multiply your profits. For example, with a 10x multiplier, a 1% market move could result in a 10% gain on your staked amount.

- Loss Limitation: If the market moves against your prediction, your losses are limited only to the amount you staked. This means you cannot lose more than what you initially put into the trade.

Using multipliers can be attractive for traders seeking higher returns with a limited capital outlay. However, it’s important to remember that leverage trading carries inherent risks, and while multipliers limit potential losses, they do not eliminate them. It’s crucial for traders to have a solid risk management strategy and to be aware of the potential volatility and market movements when using multipliers or any other leveraged product.

Always make sure to thoroughly understand the product’s mechanics, read and adhere to the platform’s terms and conditions, and consider seeking advice from a financial professional before engaging in trading activities involving multipliers or any other derivative products.

Key features of Multipliers include:

- Time Management Tools: Multipliers offer advanced time management tools that help users prioritize tasks, set goals, and allocate their time effectively. These tools enable users to optimize their daily schedules and focus on high-impact activities.

- Collaboration and Communication Platform: The product integrates a collaborative workspace that facilitates seamless communication and project management among team members. Users can work together efficiently, share ideas, and monitor progress in real time.

- Automation and Workflow Optimization: Multipliers leverage automation to streamline repetitive tasks and processes, freeing up time for users to concentrate on more strategic initiatives. This automation reduces errors and increases overall productivity.

- Data Analysis and Insights: The product incorporates powerful data analytics capabilities to provide users with valuable insights into their performance and workflows. Users can identify areas for improvement and make data-driven decisions.

- Training and Skill Development: Multipliers offer personalized training modules and skill development resources to help users enhance their abilities and stay updated with the latest trends in their industry.

- Flexibility and Customization: The product is designed to cater to diverse user needs, offering customization options to adapt to different industries and individual preferences.

- Security and Privacy: Multipliers prioritize data security and user privacy, ensuring that all sensitive information is protected with robust encryption and compliance measures.

Overall, “Multipliers” aims to revolutionize how individuals and organizations approach productivity, providing a comprehensive solution to optimize workflows, maximize output, and achieve more with existing resources.

Multipliers can be found on the D Trader platform, which is one of several platforms offered by Derv, the company formerly known as Binary.com. The change from Binary.com to Deriv marked a turning point for the company, as it became more diverse and started offering a wider range of trading options in a modern and enhanced trading environment. This change also brought improved platforms, better integration between platforms, enhanced features, tools, resources, and a wider selection of trading options and products. Multipliers are one such product.

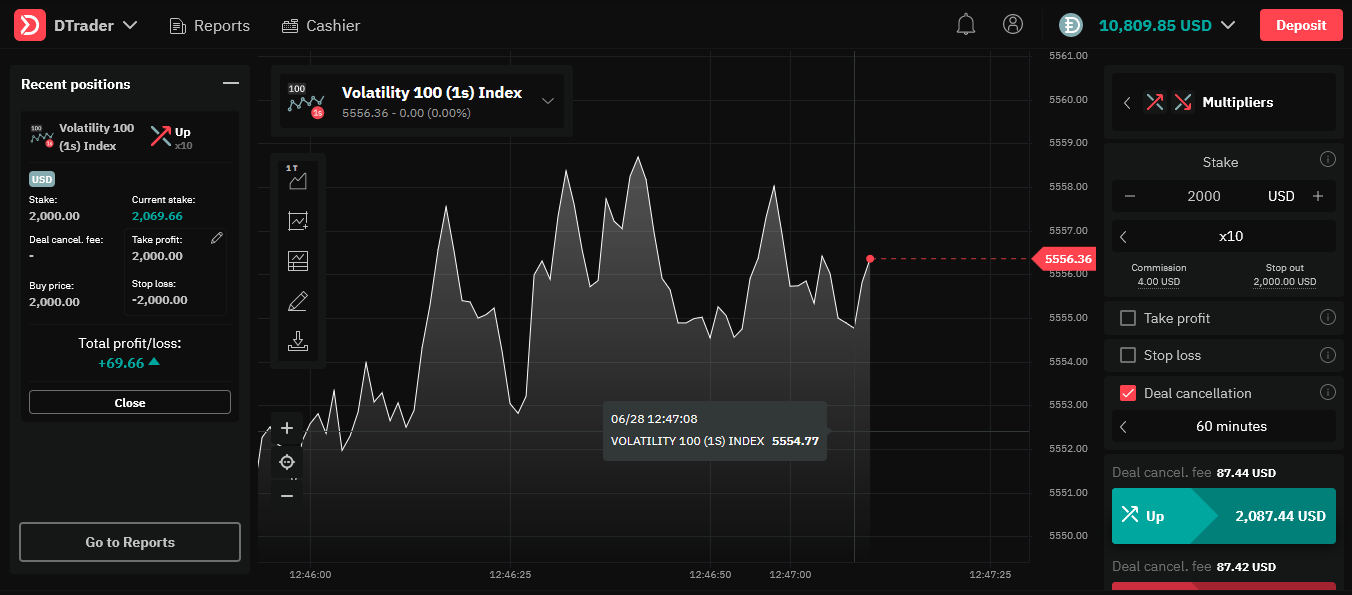

To access the D Trader platform, navigate to the designated section where you can select the product. Choose “Multipliers” from the options and set your preferences accordingly. Multipliers combine features of binary options and CFD trading. If you already understand either of these, you’re already halfway there in understanding this new product. Regardless, Multipliers are quite straightforward to grasp.

In a nutshell, Multipliers derive their profit and loss from the market’s price change, just like CFD trading. Profit and loss in Multipliers change proportionately to the underlying market’s price change. Meanwhile, your risk is always limited to your initial stake, which is the amount you initially paid to purchase the contract. This characteristic aligns with how binary options work.

Now, let’s delve into the specific features of Multipliers.

We’ll begin with the stake, which refers to your contract price or the amount you’re willing to invest in a particular contract. You can adjust this amount using the plus and minus buttons. Below the stake, you’ll find the multiplier. By clicking on it, you’ll notice that the multiplier ranges from 100 to 1,000 times. Choosing a higher multiplier means that for each price increment or percentage increase, you can earn a thousand times more. However, this is also proportional to your initial stake.

The multiplier option defines the proportion between profit and loss change and the underlying asset’s price change. It allows you to leverage your earnings and potentially earn profits at a faster rate. Conversely, the same applies to losses, which can also occur quickly. The advantage of Multipliers is that your losses are always limited to your initial stake.

Here’s a summary of the key points:

- Stake: The stake refers to the contract price or the amount the trader is willing to invest in a specific contract. Traders can adjust the stake amount using the plus and minus buttons on the platform.

- Multiplier: The platform offers a range of multipliers from 100 to 1,000 times. Selecting a higher multiplier allows traders to potentially earn profits at a faster rate, as their earnings are multiplied by the chosen multiplier. However, it is essential to understand that this also applies to losses, which can occur quickly with higher multipliers.

- Profit and Loss Potential: The multiplier option significantly impacts the profit and loss potential of a trade. With higher multipliers, profits can be amplified, but so can losses.

- Risk Management: Despite the potential for higher profits, the platform emphasizes that losses are always limited to the initial stake. This feature provides risk management benefits, as traders can only lose the amount they initially invested, regardless of the market’s adverse movements.

Overall, Multipliers appear to offer traders an opportunity to leverage their earnings and potentially increase profits quickly. However, it is essential to use this feature with caution, as higher multipliers also come with increased risk. Implementing a sound risk management strategy, including setting appropriate stop-loss and take-profit levels, can be beneficial when using Multipliers or any leveraged trading product.

Moving on to other features, we have the “Take Profit” option

The “Take Profit” option is another risk management tool used in trading to secure profits on a trade when the market moves in the trader’s favour. It is an instruction given to a broker or trading platform to automatically close a position when a predefined profit level is reached. The purpose of a take-profit order is to lock in gains and ensure that profitable trades are closed at a target price.

Here’s how the “Take Profit” option works:

- Setting the Take Profit Level: When entering a trade, a trader can specify a price level at which they want to take profits. This price level is known as the take-profit price. If the market moves in the trader’s favour and reaches or crosses the take profit price, the take profit order is triggered.

- Automatic Execution: Once the market reaches the take profit price, the take profit order is automatically executed, and the trade is closed at the prevailing market price. This ensures that the trader locks in the profit at the target level.

- Securing Profits: The primary purpose of a take-profit order is to secure profits on a winning trade. By setting a take-profit level, traders can ensure that they don’t miss an opportunity to cash in on favourable market movements.

- Balancing Risk and Reward: Taking profit orders helps traders strike a balance between risk and reward. By having a predefined profit target, traders can set realistic profit expectations for their trades and avoid being too greedy, which may lead to missed opportunities or potential losses if the market reverses.

- Automated Trading: Taking profit orders can be particularly useful in situations where traders cannot actively monitor the markets continuously. With automated take-profit orders in place, traders can let the market work in their favour without needing to constantly watch the price movements.

It’s important to note that while take-profit orders can help secure profits, they may also result in missed opportunities if the market continues moving in a favourable direction beyond the take-profit level. Traders need to strike a balance between taking profits and allowing trades to run to capture larger gains when market conditions are favourable.

Like stop-loss orders, take-profit orders are an essential part of a comprehensive risk management strategy and can be used in conjunction with other tools to manage risk and maximize potential profits in trading.

Here, you can adjust the amount using the plus and minus buttons. Take profit allows you to specify a point at which, if the market moves in your favour, the contract will automatically close, and you will receive the specified amount without any manual intervention. On the other hand, “Stop Loss” works inversely. It allows you to set a point at which, if the market moves against you continuously, and eventually hits the specified amount in losses, the contract will close to limit your losses. It acts as a safeguard to prevent you from losing your entire stake.

Stop Loss Feature

A stop-loss order is a risk management tool used in trading to limit potential losses on a position. It is an instruction given to a broker or trading platform to automatically close a trade when the market price reaches a specified level. The purpose of a stop-loss order is to protect a trader’s capital by preventing further losses beyond a predetermined threshold.

Here’s how a stop-loss order works:

- Setting the Stop Loss: When entering a trade, a trader can specify a price level at which they are willing to accept a loss. This price level is known as the stop-loss price. If the market moves against the trader’s position and reaches or crosses the stop-loss price, the stop-loss order is triggered.

- Automatic Execution: Once the market reaches the stop-loss price, the stop-loss order is automatically executed, and the trade is closed at the prevailing market price. This ensures that the trader exits the trade before incurring further losses.

- Limiting Losses: The primary purpose of a stop-loss order is to limit potential losses on a trade. By setting a stop-loss, traders can define their maximum acceptable loss for a particular trade and protect their trading capital from significant drawdowns.

- Market Volatility: It’s important to consider market volatility when setting a stop-loss level. Setting the stop-loss too close to the entry price may result in premature triggering of the order due to normal market fluctuations, while setting it too far away may expose the trader to larger potential losses.

Stop-loss orders are essential risk management tools that help traders maintain discipline and protect their capital. They are particularly crucial in leveraged trading, where market movements can result in amplified gains or losses. By using stop-loss orders effectively, traders can maintain better control over their risk exposure and overall trading strategy. However, it’s essential to understand that stop-loss orders do not guarantee that the trade will be closed exactly at the specified price in all market conditions, particularly during fast-moving or volatile markets, where slippage may occur.

Next, we have the “Deal Cancellation” feature

When you click on deal cancellation, the take profit and stop loss options are automatically unchecked. You can only use one of these features at a time, or both simultaneously. Deal cancellation has an associated duration ranging from five minutes to 60 minutes. During this duration, you cannot select take profit or stop loss. However, once the duration expires, you can choose either or both options again. Deal cancellation allows you to close the contract and receive your entire stake back if the market moves against you during the duration. However, keep in mind that there is a deal cancellation fee associated with this feature, similar to an insurance premium that limits your risk.

These are the main features available with Multiplier contracts. Now, let’s move on to setting up a few actual trades. To start, you can purchase a contract without any additional features activated.

Here’s a summary of how the Deal Cancellation works:

- Selecting Deal Cancellation: Traders have the option to use the Deal Cancellation feature when placing a trade on Multiplier contracts. When they activate this feature, the take profit and stop loss options are automatically unchecked, allowing traders to use only one of these features at a time or both simultaneously.

- Duration: The Deal Cancellation comes with an associated duration, which can be set by the trader and typically ranges from five minutes to 60 minutes. During this specified duration, traders cannot select or activate the take profit or stop loss options.

- Market Protection: The primary benefit of the Deal Cancellation is that it provides a level of protection for traders in case the market moves against their position during the specified duration. If the trader’s prediction turns out to be incorrect, they have the opportunity to cancel the contract and receive their entire stake back, mitigating potential losses.

- Deal Cancellation Fee: To use the Deal Cancellation feature, traders need to pay a deal cancellation fee, similar to an insurance premium. This fee acts as a cost to limit the trader’s risk. By paying this fee, traders have the peace of mind that they can exit the trade and recover their initial stake if needed.

It’s essential for traders to carefully consider the deal cancellation fee and the associated duration before activating this feature. The fee and duration should be weighed against the trader’s confidence in their prediction and the potential risks involved in the trade.

Deal Cancellation can be a valuable tool for managing risk and providing an extra layer of flexibility in volatile markets. It allows traders to be more adaptable and responsive to changing market conditions while limiting the impact of potential unfavourable price movements. However, traders should be aware of the additional cost associated with this feature and use it judiciously as part of their overall risk management strategy.

Reviewing and confirming your trade details before execution

Reviewing and confirming your trade details before execution is a crucial step to ensure accuracy and avoid potential mistakes. Here are some additional points to keep in mind during the review and monitoring process:

Review and Confirm:

- Trade Parameters: Check that the trade parameters, such as the trade amount, leverage (if applicable), stop-loss level, and take-profit level, are set according to your trading strategy and risk management plan.

- Asset Selection: Verify that you have selected the correct asset within the chosen contract type. Ensure you are trading the asset you intended to trade.

- Account Balance: Ensure that you have enough funds in your trading account to cover the margin requirements for the trade you wish to execute.

- Market Conditions: Consider the current market conditions, news, and events that may impact the asset’s price. Make informed decisions based on the available information.

Monitor the Trade:

- Price Movements: Keep a close eye on the price movements of the asset you’re trading. Understand that prices can fluctuate rapidly, and monitoring the trade will help you respond to changes in the market.

- Stop-loss and Take-profit: If you set stop-loss and take-profit levels, be prepared to close the trade automatically if the price reaches these levels. This can help you limit potential losses and secure profits.

- Trading Plan Adherence: Stick to your trading plan and avoid making impulsive decisions based on short-term market fluctuations. Emotions can lead to hasty actions that may not align with your overall strategy.

- Market News: Stay informed about any news or developments that could affect your trade. Major news events can significantly impact asset prices.

- Risk Management: Continuously assess the risk-to-reward ratio of your trade. Avoid risking more than you can afford to lose on a single trade.

- Technical Analysis: If you use technical analysis in your trading strategy, keep track of relevant indicators and chart patterns to support your decisions.

- Exit Strategy: Have a clear exit strategy in mind before entering the trade. Decide when you’ll close the trade to take profits or cut losses if the market moves in an unfavourable direction.

Remember that trading involves inherent risks, and no strategy guarantees profits. Be prepared to accept losses as part of the trading process and learn from each trade, whether it ends in profit or loss. Regularly evaluate your trading performance and adapt your approach based on your experiences in the market.

Conclusion

In conclusion, “Multipliers” is an exciting and innovative product that promises to be a game-changer for individuals and businesses alike. By offering a suite of tools and methodologies, the product empowers users to achieve higher levels of productivity and efficiency, ultimately leading to better outcomes and success in their endeavours.

With features such as advanced time management tools, collaboration and communication platforms, automation and workflow optimization, data analysis and insights, personalized training modules, and a strong focus on security and privacy, “Multipliers” addresses various aspects crucial to enhancing productivity and performance.

As users leverage the capabilities of “Multipliers,” they can expect to streamline their daily tasks, improve collaboration and communication among team members, automate repetitive processes, gain valuable insights from data analysis, and develop essential skills for personal and professional growth.

In a world where productivity and efficiency play a vital role in achieving success, “Multipliers” stands out as a promising solution that has the potential to transform the way individuals and businesses operate. By harnessing the power of this product, users can unlock their full potential and accomplish more with the same resources, making it a valuable addition to any organization or individual striving for excellence.