- How to Start Trading on Deriv

- Forex trading is available on multiple trading platforms

- Introduction to Deriv

- How to Start Trading on Deriv

- Creating a Demo Account:

- Creating a Real Account:

- Making a Deposit:

- Create an Account on DerivX

- To log in to the DerivX platform and start trading:

- For the DerivX mobile app:

- Trade Using Multipliers on Deriv’s DTrader Platform:

- Conclusion

How to Start Trading on Deriv

Forex, also known as foreign exchange, is a global marketplace for exchanging currencies.

It is the largest and most accessible financial market in the world, with over USD 6 trillion traded daily. Forex trading involves the exchange of one currency for another in the Forex market, which operates 24 hours a day from Sunday to Friday.

In Forex trading, currencies are traded in pairs. The first currency in the pair is called the base currency, and the second currency is called the quote currency. For example, in the EUR/USD pair, the euro is the base currency, and the US dollar is the quote currency. The price of a currency pair represents how much one unit of the base currency is worth in terms of the quote currency.

Forex currency pairs are categorized into three types: major, minor, and exotic pairs. Major pairs are the most actively traded currencies in the Forex market, such as EUR/USD, USD/JPY, GBP/USD, and USD/CHF. Minor pairs, also known as cross pairs, include currencies that don’t involve the US dollar, such as EUR/GBP or GBP/JPY. Exotic pairs involve a major currency paired with the currency of an emerging economy, like USD/TRY (US dollar/Turkish lira) or EUR/PLN (euro/Polish zloty).

In addition to currency pairs, you can also trade Forex basket indices. Basket indices are weighted indices that measure the value of one currency against a basket of major currencies, each weighted at 20%. For example, the Australian dollar basket measures the value of the Australian dollar against the US dollar, euro, British pound sterling, Japanese yen, and Canadian dollar. This allows you to trade the Australian dollar against 20% of the total value of each of the five currencies, providing more diversification and risk-spreading opportunities.

Forex trading is available on multiple trading platforms

Deriv, including Deriv MT5, DerivX, D-Trade, and Teapot. These platforms support various trade types, including CFDs, options, and multipliers. CFDs (Contracts for Difference) allow you to speculate on the price movements of currency pairs without owning the underlying assets. Options provide the right, but not the obligation, to buy or sell a currency pair at a predetermined price within a specific timeframe. Multipliers enable you to amplify your potential profits and losses by a certain factor, depending on the selected multiplier value.

With the availability of different platforms and trade types, Deriv provides traders with flexibility and a range of options to participate in Forex trading.

Introduction to Deriv

Deriv is an online trading platform that provides access to a wide range of financial markets, allowing you to trade 24/7. Whether you’re a beginner or an experienced trader, Deriv offers clear and flexible options to trade various instruments such as forex, commodities, synthetic indices, stock indices, and cryptocurrencies. You can access these markets using mobile platforms such as Dtrader, Smart Trader, MetaTrader 5, Deriv X, or Deriv GO.

With Deriv, you can benefit from competitive prices, tighter spreads, and a suite of tools designed to help you manage risk and maximize profits. Whether you anticipate a market to rise, fall, or move sideways, Deriv empowers you to trade by your strategies and goals. With a 21-year history, Deriv is committed to breaking barriers and democratizing trading, offering you the necessary tools on your mobile device to achieve your financial objectives.

Traders from around the world rely on Deriv, executing over 60 million trades per month on our platform. If you’re ready to experience the Deriv difference, you can visit Deriv.com or download the Deriv Go app today. Start your trading journey with Deriv and explore the opportunities available to you.

How to Start Trading on Deriv

To start trading, you need to create a Deriv account and make your first deposit. Follow these steps:

- Create an Account: Visit the Deriv website and sign up for an account. You’ll need to provide your email address, create a password, and agree to the terms and conditions.

- Verify Your Account: After signing up, you may need to verify your email address. Deriv might also require you to verify your identity by providing some personal information and documentation, such as a government-issued ID or passport, as part of their Know Your Customer (KYC) procedures.

- Deposit Funds: Once your account is verified, you can proceed to deposit funds into your Deriv account. Deriv supports various deposit methods, including bank transfers, credit/debit cards, and e-wallets. Choose the option that’s most convenient for you and follow the instructions to complete the deposit.

- Choose a Trading Platform: Deriv offers different trading platforms, including DMT5 (Deriv MetaTrader 5), DTrader, and DBot. Decide which platform you want to use for trading. DMT5 is a popular choice for more advanced traders, while DTrader is a simpler platform suitable for beginners. DBot is a platform for automated trading.

- Familiarize Yourself with the Platform: Once you’ve chosen a trading platform, take some time to familiarize yourself with its features and functionalities. Learn how to place trades, set stop-loss and take-profit orders, and analyze charts.

- Start Trading: After depositing funds and becoming familiar with the platform, you’re ready to start trading. Decide which assets you want to trade (e.g., forex, commodities, cryptocurrencies) and develop a trading strategy. Remember to trade responsibly and never risk more than you can afford to lose.

- Monitor Your Trades: Keep an eye on your open trades and monitor market conditions. You may need to adjust your positions or take profits/losses based on changing market dynamics.

- Withdraw Profits: If you’ve made profits from your trades and wish to withdraw funds from your Deriv account, you can do so through the withdrawal section of the platform. Follow the instructions to initiate a withdrawal, and the funds will be transferred to your designated withdrawal method.

Remember to stay informed about market trends, manage your risk effectively, and continuously educate yourself to improve your trading skills.

Creating a Demo Account:

- Visit deriv.com and click on the “Create free demo account” button.

- Enter your email address and tick the terms and conditions checkbox if you agree.

- Click the “Create demo account” button.

- You can sign up using your Google, Facebook, or Apple account by clicking the respective button and following the instructions. Alternatively, if you use your email address, you’ll receive a confirmation email in your inbox.

- Open the email you received and click the “Verify my email” button to confirm your email address.

- You’ll be redirected back to Deriv. Select your country of residence and create a secure password.

- Once you’ve entered your details, click the “Start trading” button. Congratulations! You now have a Deriv demo account.

Creating a Real Account:

- In the top right corner of your screen, click on your balance amount. This will open a drop-down menu with available account options.

- Select the “Real” tab and click the “Add” button next to the Deriv account.

- Choose your preferred currency for deposits and click “Next.”

- Follow the instructions on the screen to enter your details and address.

- Check the terms of use and click “Add account.” Your real Deriv account is now created.

Making a Deposit:

- On your cashier page, click “Deposit.”

- Select your preferred payment method from the options available.

- Follow the instructions on the screen to complete the deposit process.

- Once your funds are reflected in your account, which you can check in the top right corner of your screen, you are ready to start trading with real money.

That’s it! You have successfully created a Deriv account, made your first deposit, and can now start trading with Deriv.

Create an Account on DerivX

To create an account on DerivX and start trading, follow these steps:

- Log in to your Deriv account.

- Choose DerivX from the app switcher located at the top of the page. This will take you to the DerivX dashboard.

- On the DerivX dashboard, you have the option to create either a real account to trade with real money or a demo account to practice trading with virtual funds.

- For a demo account, go to the “Demo account” tab and click “Add demo account.”

- Enter a password for your demo account.

- Your DerivX demo synthetic account is now created. Your username and password will be the same for all future DerivX accounts.

To log in to the DerivX platform and start trading:

- Copy the username displayed on your DerivX dashboard.

- Click on “Trade on web terminal” to access the DerivX platform.

- Paste your username in the provided field.

- Fill in your DerivX password.

- Click “Log in” to access the platform and start trading.

For the DerivX mobile app:

- Log in with your username from the DerivX dashboard.

- Enter the password you set for your DerivX account.

- You are now logged in and ready to start trading.

If you want to practice trading on different assets or start trading with real money:

- Go back to the DerivX dashboard.

- Select your preferred account type (real or demo).

- Click “Add account.”

- Use the same username and password combination to create

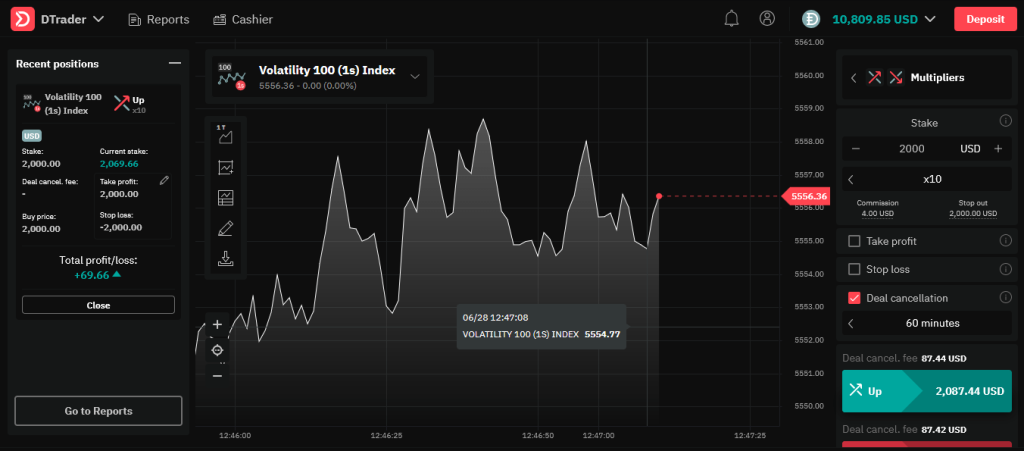

Trade Using Multipliers on Deriv’s DTrader Platform:

Deriv’s DTrader platform provides a user-friendly interface for trading with multipliers. Here’s a step-by-step guide on how to trade using multipliers on DTrader:

- Login to your Deriv account and select the DTrader platform.

- Choose the asset you want to trade by clicking on the “+” button on the left sidebar and selecting the desired asset from the list.

- In the trading interface, specify the stake amount by using the plus and minus buttons or by manually entering the desired stake.

- Select the multiplier you wish to apply to your trade. You can adjust the multiplier value using the plus and minus buttons or by manually entering the desired value. Remember that higher multipliers amplify both potential profits and losses.

- Choose the direction of your trade by clicking on the “Up” or “Down” button, depending on whether you anticipate the price of the asset to rise or fall.

- Set optional parameters such as take profit and stop loss levels. Take profit allows you to automatically close the trade and lock in profits when the market moves in your favour, while stop loss lets you limit potential losses by automatically closing the trade if the market moves against you.

- If you want to use the deal cancellation feature, you can enable it by clicking on the “Enable deal cancellation” checkbox. Deal cancellation allows you to close the trade and receive your entire stake back within a specified duration, even if the market moves against you. Note that deal cancellation incurs a fee.

- Review your trade parameters and ensure everything is set according to your preferences.

- Click on the “Purchase” button to execute the trade.

- Monitor your open positions in the “Open Positions” tab to track the progress of your trades.

- You can adjust or close your trades manually at any time before they reach the take profit, stop loss, or deal cancellation levels.

Conclusion

Remember to always practice responsible trading by carefully managing your risks and setting appropriate parameters for each trade. The DTrader platform provides you with the necessary tools to analyze the market, execute trades with multipliers, and monitor your positions effectively.