इस लेख में हम विदेशी मुद्रा व्यापार की मूल बातें जानेंगे।

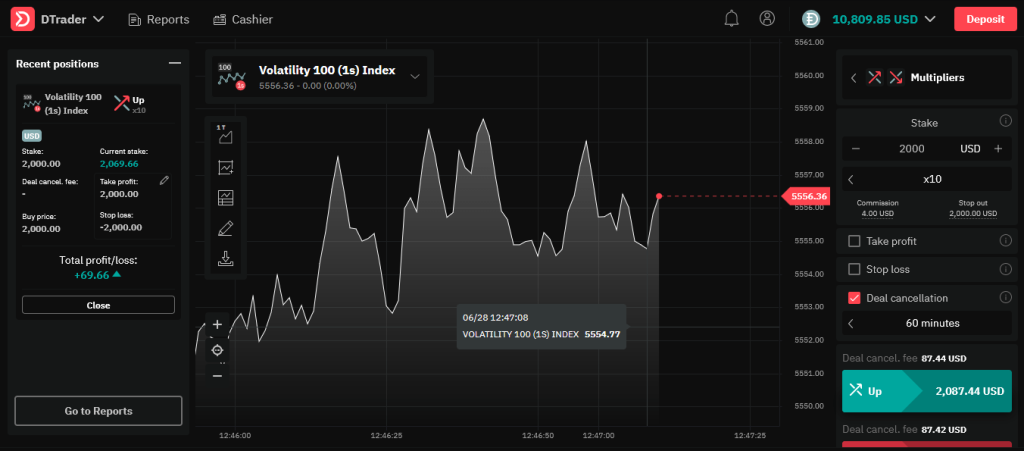

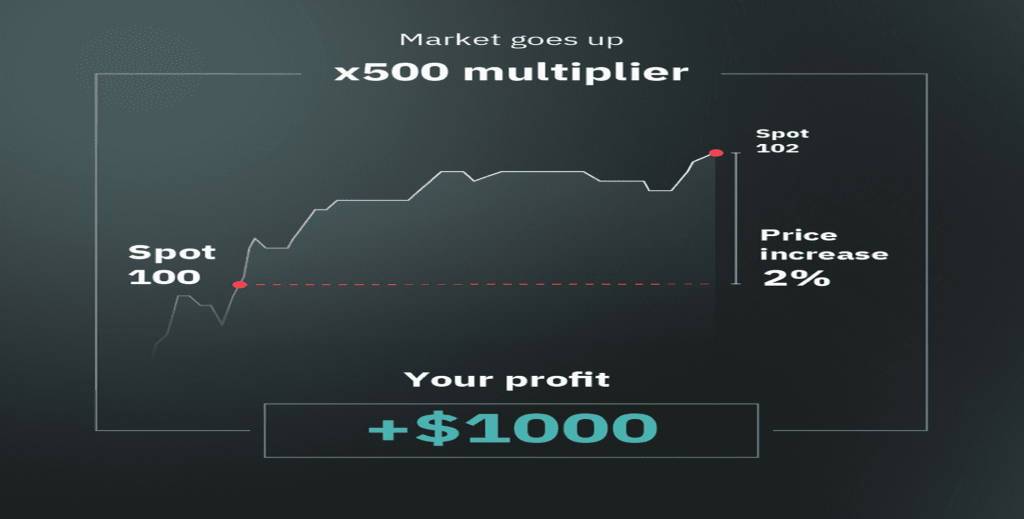

Table Of Contents Toggle the Table of Contents इस लेख में हम विदेशी मुद्रा व्यापार की मूल बातें जानेंगे। हालांकि कुछ व्यक्तियों के लिए यह शुरूआत में कुछ भ्रांतिकर हो सकता है, मुद्रा यद्यपि कुछ व्यक्तियों के लिए यह शुरुआत में कुछ भ्रांतिकर हो सकता है, मुद्रा जोड़ी को खरीदना या बेचना सीधा होता है। मुद्रा व्यापार में, मुद्राएँ हमेशा जोड़ी में व्यापार होती हैं। प्रत्येक मुद्रा जोड़ी दो मुद्राओं के बीच Click on the Table of Contents to navigate. इस लेख में हम विदेशी मुद्रा व्यापार की मूल बातें जानेंगे। चलिए, हम विदेशी मुद्रा बाजार की मूल बातों में प्रवेश करेंगे, जिसे विदेशी मुद्रा बाजार के रूप में भी जाना जाता है। विदेशी मुद्रा बाजार क्या है? विदेशी मुद्रा बाजार एक अणूष्ठित वैश्विक बाजार है जहां मुद्राएँ खरीदी और बेची जाती हैं। यह दुनिया का सबसे बड़ा और सबसे लिक्विड वित्तीय बाजार है, जिसमें दैनिक व्यापार राशि ट्रिलियन डॉलर्स तक पहुंचती है। विदेशी मुद्रा बाजार के प्रतिभागी: विदेशी मुद्रा बाजार के मुख्य प्रतिभागी में बैंक, केंद्रीय बैंक, कॉर्पोरेट, सरकारें, संस्थागत निवेशक, खुदरा व्यापारी, और स्वागतशील होते हैं। इन प्रतिभागियों का मुख्य उद्देश्य विभिन्न उद्देश्यों के लिए मुद्रा व्यापार करना है, जैसे कि अंतरराष्ट्रीय व्यापार, निवेश, हेजिंग, और शोध। मुद्रा जोड़ीयाँ: विदेशी मुद्रा व्यापार में हमेशा मुद्राएँ जोड़ीयों में व्यापार की जाती हैं। प्रत्येक मुद्रा जोड़ी दो मुद्राओं के बीच विनिमय दर को प्रतिष्ठान मुद्रा और उद्धृत मुद्रा के रूप में प्रतिष्ठित करती है। उदाहरण के लिए, EUR/USD जोड़ी में, पहली मुद्रा (EUR) मूल मुद्रा है, और दूसरी मुद्रा (USD) कोट मुद्रा है। विनिमय दर दिखाता है कि मूल मुद्रा की एक इकाई खरीदने के लिए कितनी कोट मुद्रा की आवश्यकता है। बाजार का समय: विदेशी मुद्रा बाजार 24 घंटे प्रतिदिन, पाँच दिन प्रतिसप्ताह काम करता है। इसका प्रारंभ रविवार रात (GMT) को एशियाई सत्र के खुलने से होता है और शुक्रवार अपराह्न (GMT) को यूएस सत्र के बंद होने तक चलता है। बाजार को तीन प्रमुख सत्रों में बाँटा गया है: एशियाई, यूरोपीय, और उत्तर अमेरिकन सत्र। विदेशी मुद्रा मूल्यों को प्रभावित करने वाले कारक: विदेशी मुद्रा मूल्यों को आर्थिक सूचकांक, भौगोलिक घटनाएँ, केंद्रीय बैंक नीतियाँ, ब्याज दरें, मुद्रास्फीति, बाज ार भावना, और अन्य मैक्रोआर्थिक कारकों से प्रभावित किया जाता है। समाचार के विज्ञप्तियाँ और आर्थिक डेटा को मुद्रा मूल्यों पर भारी प्रभाव हो सकता है। व्यापारिक विधियाँ: विदेशी मुद्रा व्यापार को विभिन्न विधियों के माध्यम से किया जा सकता है, जैसे कि स्पॉट व्यापार, फ्यूचर्स कॉन्ट्रैक्ट्स, ऑप्शन्स, और परिसंवर्धन। खुदरा व्यापारियों के लिए सबसे सामान्य विधि स्पॉट व्यापार है, जहां व्यापार “तत्काल” मौद्रिक मूल्य पर समाप्त होते हैं। लीवरेज और मार्जिन व्यापार: विदेशी मुद्रा व्यापार अक्सर लीवरेज का उपयोग करता है, जिससे व्यापारियों को छोटे पूंजी के साथ अधिक स्थानों को नियंत्रित करने की अनुमति होती है। लीवरेज लाभ और हानि दोनों को बढ़ाता है। मार्जिन व्यापार के लिए व्यापारियों को अपने व्यापार खातों में कुछ निर्धारित राशि को बनाए रखना होता है, जिससे संभावित हानियों को कवर किया जा सकता है। तकनीकी और मौद्रिक विश्लेषण: व्यापारी दो प्रमुख विधियों का उपयोग करके विदेशी मुद्रा बाजार का विश्लेषण […]

इस लेख में हम विदेशी मुद्रा व्यापार की मूल बातें जानेंगे। Read More »