Table Of Contents

- The Economics of Bitcoin Mining: Profits, Investment, and Timeframes

- Bitcoin Mining Profitability Factors:

- Is Bitcoin mining a good way to make money?

- Evaluating Bitcoin Mining as a Source of Income:

- Risk Assessment in Bitcoin Mining:

- Are Bitcoin miners a good investment?

- Key Factors Influencing Bitcoin Mining Investments:

- Risk Mitigation and Informed Decision-Making:

- How long does it take to mine 1 block of Bitcoin?

- Factors Influencing Block Mining Time:

- Mining Pools and Consistent Rewards:

- Conclusion

Click on the Table of Contents to navigate.

The Economics of Bitcoin Mining: Profits, Investment, and Timeframes

Introduction: Bitcoin mining has become a hot topic in the financial world, with many intrigued by the potential for profits and investment opportunities. In this article, we’ll explore the questions surrounding Bitcoin mining, from its profitability to its viability as an investment.

-

How Much Profit Do Bitcoin Miners Make?

Bitcoin Mining Profits: Factors, Figures, and Fluctuations

Delving into the world of Bitcoin mining means navigating through a myriad of factors that impact profitability. In this section, we will dissect the key elements influencing the earnings of Bitcoin miners and provide insights into the ever-changing dynamics of this lucrative endeavour.

Bitcoin Mining Profitability Factors:

- Current Price of Bitcoin: The cornerstone of Bitcoin mining profits lies in the digital currency’s market value. As of [current date], each mined Bitcoin is worth [insert current figure], constituting a significant portion of a miner’s potential daily earnings.

- Mining Difficulty: The complexity of mining operations, often referred to as mining difficulty, plays a pivotal role. Mining difficulty adjusts approximately every two weeks to maintain the 10-minute block time target. Higher difficulty levels require more computational power, impacting the time and resources needed to mine a block.

- Operational Costs: Beyond market factors, miners must grapple with operational costs, including electricity, cooling, and maintenance expenses. The efficiency of mining hardware also contributes to operational costs, influencing the overall profitability equation.

Average Daily Profit for Bitcoin Miners: As of [current date], the average daily profit for Bitcoin miners stands at [insert current figure]. This figure serves as a benchmark, reflecting the potential earnings for miners based on the prevailing market conditions and operational efficiency.

Understanding Profit Fluctuations: It’s crucial to underscore that Bitcoin mining profits are not static. Fluctuations are inherent and influenced by the volatility of the cryptocurrency market. Factors such as sudden price fluctuations, regulatory developments, and technological advancements can lead to rapid changes in mining profitability.

Optimizing Key Phrases: When navigating the intricate landscape of Bitcoin mining profits, staying abreast of the current price of Bitcoin, mining difficulty, and operational costs is paramount. As of [current date], the average daily profit for Bitcoin miners is [insert current figure], but the dynamic nature of the market emphasizes the need for continuous monitoring and adaptation.

In the realm of Bitcoin mining, understanding the nuanced interplay between market dynamics and operational considerations is key to maximizing profits. As we navigate the evolving landscape of cryptocurrency, staying informed and adaptable remains the cornerstone of success for Bitcoin miners.

-

Is Bitcoin mining a good way to make money?

A Comprehensive Analysis

Embarking on the journey of Bitcoin mining is akin to navigating uncharted waters where potential profits beckon, but careful consideration is paramount. In this segment, we delve into the question of whether Bitcoin mining stands as a viable means to financial gain and unravel the critical factors that define success in this dynamic realm.

Evaluating Bitcoin Mining as a Source of Income:

- Lucrative Potential: Bitcoin mining has proven to be a potentially lucrative venture, with individuals attaining substantial profits. The allure lies in the rewards offered for validating transactions and adding blocks to the blockchain.

- Factors Influencing Success: Success in Bitcoin mining hinges on several pivotal factors. The initial investment in high-performance mining hardware, electricity costs, and the ability to adapt to market fluctuations are crucial considerations. The profitability equation is intricate and demands a strategic approach.

- Ever-Changing Market Conditions: The cryptocurrency space is characterized by rapid and often unpredictable market changes. Staying informed about the latest developments, price trends, and regulatory shifts is essential for miners to adjust their strategies and optimize their profitability.

Risk Assessment in Bitcoin Mining:

- Market Volatility: Bitcoin’s value is notorious for its volatility. While this volatility presents profit opportunities, it also introduces risks. Sudden price fluctuations can impact mining profitability, emphasizing the need for a risk management strategy.

- Technological Advancements: The landscape of Bitcoin mining evolves with technological advancements. Upgrading mining hardware is an ongoing requirement to stay competitive. However, these advancements come with costs and must be carefully weighed against potential benefits.

Guidance for Aspiring Miners: Entering the competitive field of Bitcoin mining demands a cautious approach. Aspiring miners should conduct thorough research, assessing their risk tolerance and investment capabilities. Consulting with industry experts can provide valuable insights into the current landscape and potential future developments.

While Bitcoin mining holds the promise of financial gain, it is not without its challenges. Success requires a blend of strategic planning, adaptability to market conditions, and a keen awareness of associated risks. Aspiring miners should approach this endeavour with a well-informed perspective, understanding that the path to profitability requires diligence, research, and a commitment to staying ahead in this ever-evolving sector.

-

Are Bitcoin miners a good investment?

Deciphering the Investment Landscape of Bitcoin Miners: Factors, Returns, and Risk Mitigation

Introduction: Delving into Bitcoin mining as an investment avenue requires a nuanced understanding of the associated factors that can influence returns. In this exploration, we dissect the question of whether Bitcoin miners make for a prudent investment, shedding light on the considerations that can define success in this evolving sector.

Key Factors Influencing Bitcoin Mining Investments:

- Hardware Investment: The cornerstone of Bitcoin mining investments is the acquisition and maintenance of mining hardware. The efficiency and computational power of these devices directly impact potential returns. Investors need to stay abreast of technological advancements to ensure their hardware remains competitive.

- Electricity Costs: The operational costs of mining, primarily electricity consumption, are pivotal in determining profitability. Mining in regions with lower electricity costs can significantly enhance the feasibility of the investment. Strategies to optimize energy efficiency become crucial in this context.

- Market Conditions: Bitcoin mining returns are intricately tied to the broader cryptocurrency market. Historical data shows that investors have enjoyed returns, particularly during bullish market trends. Understanding market dynamics and anticipating potential shifts are vital components of a successful mining investment strategy.

Historical Returns and Market Trends: Examining historical data reveals instances where investors in Bitcoin mining operations reaped substantial returns, especially during periods of favourable market conditions. However, it’s imperative to recognize that past performance is not indicative of future results, and the cryptocurrency market is known for its inherent volatility.

Risk Mitigation and Informed Decision-Making:

- Risk Tolerance Analysis: Potential investors must conduct a thorough analysis of their risk tolerance before entering the Bitcoin mining arena. Volatility in cryptocurrency markets can lead to both rapid gains and losses, necessitating a clear understanding of one’s comfort level with such fluctuations.

- Due Diligence: In the ever-changing landscape of cryptocurrency, due diligence is paramount. This involves continuous research on market trends, regulatory developments, and technological advancements. A well-informed investor is better equipped to navigate the uncertainties of the market.

- Professional Guidance: Seeking advice from financial professionals with expertise in the cryptocurrency domain can provide valuable insights. Professionals can offer tailored advice based on individual financial goals, risk tolerance, and the prevailing market conditions.

While Bitcoin mining operations have historically yielded returns for some investors, the decision to invest should be approached with careful consideration. Assessing hardware efficiency, electricity costs, and market conditions is crucial, and investors should continually adapt their strategies based on the evolving dynamics of the cryptocurrency sector.

-

How long does it take to mine 1 block of Bitcoin?

Understanding Bitcoin Block Mining Durations

The quest to mine a block of Bitcoin is a dynamic journey influenced by factors like network hash rate and mining difficulty. In this exploration, we unravel the intricacies of the time it takes to mine one block, shedding light on the average duration and the role of mining pools in ensuring a steady income stream.

Factors Influencing Block Mining Time:

- Network Hash Rate: The total computational power of the Bitcoin network, known as the hash rate, plays a pivotal role. A higher hash rate implies increased competition among miners, potentially extending the time required to mine a block.

- Mining Difficulty: Mining difficulty adjusts every two weeks to maintain the 10-minute block time target. Higher difficulty levels demand more computational power, making the process more challenging and time-consuming for individual miners.

Average Block Mining Duration: On average, a new block is added to the Bitcoin blockchain approximately every 10 minutes. This figure serves as a benchmark, representing the network’s collective computational efficiency. However, it’s essential to note that individual miners may experience variations in the time required to solve a block based on their computational power and luck.

Mining Pools and Consistent Rewards:

- Pooling Resources: Mining pools offer a collaborative approach where individual miners combine their computational resources. This pooling of resources enhances the collective hash rate, increasing the likelihood of successfully mining blocks in a more predictable timeframe.

- Steady Income Stream: Joining a reputable mining pool provides miners with more consistent and predictable rewards. While individual miners might experience variability in block-solving times, mining pools distribute rewards among participants based on their contributed computational power. This structure ensures a steady income stream for participants.

Optimizing Block Mining Strategies: Understanding the dynamics of block mining times empowers miners to optimize their strategies. Individual miners might consider factors such as hardware efficiency, electricity costs, and participation in mining pools to enhance their chances of regular and predictable block rewards.

Conclusion

The time it takes to mine one block of Bitcoin is a multifaceted interplay of network dynamics and individual computational power. While the average block time remains around 10 minutes, miners can navigate this landscape strategically by leveraging mining pools for a more stable and predictable income stream.

Bitcoin mining offers opportunities for profit and investment, but it requires careful consideration of various factors. As the cryptocurrency landscape evolves, staying informed and adapting strategies will be crucial for those involved in mining operations.

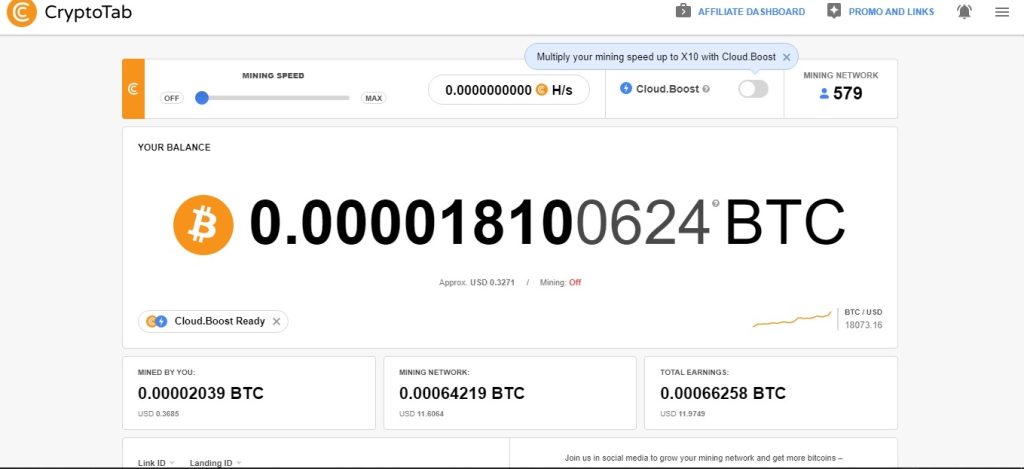

Download The Browser That Will Mine Bitcoin For You

Start Mining Bitcoin Without Investing