Make Consistent Money With Forex

Make Consistent Money With Forex: A Complete Guide for Traders

Introduction: Why Forex Trading Appeals to Ambitious Traders

Forex trading, or foreign exchange trading, is one of the most popular ways to generate income online. With daily trading volumes exceeding $6 trillion globally, the Forex market offers enormous opportunities for those who understand its dynamics. However, making consistent money with Forex is not about luck; it requires education, discipline, and a well-defined approach. In this guide, we'll explore the steps, strategies, and best practices that allow traders to achieve consistent profitability while managing risk effectively.

Step 1: Gain a Solid Foundation Through Knowledge and Education

The first step to achieving consistent success in Forex trading is building a strong foundation. Knowledge is your most valuable asset, and investing time in learning about Forex basics will pay dividends in the long run.

Start by understanding:

- Currency Pairs: Learn how major, minor, and exotic currency pairs function.

- Market Mechanics: Understand how leverage, margin, and spreads affect trades.

- Fundamental Analysis: Study macroeconomic indicators, central bank policies, interest rates, and geopolitical events that influence currency movements.

- Technical Analysis: Familiarise yourself with chart patterns, candlestick formations, trend lines, support/resistance levels, and indicators like RSI, MACD, and moving averages.

- Trading Strategies: Explore day trading, swing trading, scalping, and trend-following approaches.

Online resources, webinars, and courses offered by reputable platforms can significantly enhance your understanding. For beginners, using demo accounts is a risk-free way to practice trading strategies before committing real capital.

Step 2: Develop a Well-Defined Trading Strategy

Successful traders operate according to a clearly defined plan. Your strategy should align with your risk tolerance, trading style, and financial goals.

Determine Your Trading Style

Trading styles vary in terms of trade duration, frequency, and required attention:

- Day Trading: Positions are opened and closed within the same trading day. This style requires active monitoring and quick decision-making.

- Swing Trading: Trades are held for several days or weeks to capture medium-term trends. Swing trading is less time-intensive and suits part-time traders.

- Scalping: Short-term trades lasting minutes or hours, aiming for small profits repeatedly. Scalping demands discipline and rapid execution.

Choose a style that suits your lifestyle, risk tolerance, and market understanding. Remember, no single style guarantees profits--success comes from consistent execution.

Backtest and Demo Test Your Strategy

Before risking real capital, test your strategy extensively. Use demo accounts to simulate live market conditions. Track your results, identify weaknesses, and refine your plan. Backtesting historical data allows you to understand how your strategy performs across different market conditions, including trending, consolidating, and volatile phases.

Step 3: Implement Robust Risk Management

Protecting your trading capital is crucial for long-term success. Many traders fail not because of poor strategies but due to inadequate risk management.

Set Stop-Loss and Take-Profit Levels

Always define your maximum acceptable loss per trade with stop-loss orders. Simultaneously, use take-profit orders to lock in gains. This ensures that your trades are disciplined and not swayed by emotions.

Calculate Position Size Carefully

Never risk more than a small percentage of your trading account on a single trade--commonly 1-3%. Determine position size based on your stop-loss distance and risk tolerance to avoid catastrophic losses.

Limit Leverage

While leverage can amplify profits, it also increases risk. Use leverage conservatively, particularly as a beginner, until you gain experience and confidence in managing trades under various market conditions.

Step 4: Master Technical and Fundamental Analysis

Consistent traders combine both technical and fundamental analysis to identify profitable trading opportunities.

Technical Analysis Tools

Use charts, trendlines, and indicators to identify potential entry and exit points. Popular tools include:

- Moving Averages (SMA, EMA)

- Relative Strength Index (RSI)

- MACD (Moving Average Convergence Divergence)

- Fibonacci Retracements

- Support and Resistance Levels

Technical analysis helps you spot trends, reversals, and breakout opportunities while controlling risk effectively.

Fundamental Analysis for Forex

Consider economic data releases, interest rate decisions, geopolitical events, and global trade news. For example, strong economic growth in the U.S. can strengthen the USD, while political instability in emerging markets may weaken their currencies. Combining fundamental and technical analysis provides a well-rounded view of market conditions.

Step 5: Implement Effective Money Management

Consistent profitability requires careful money management:

- Determine the maximum capital to risk per trade.

- Limit the number of simultaneous open positions.

- Diversify your trades across multiple currency pairs to reduce exposure.

- Maintain a trading journal to track performance and decisions.

By managing your capital wisely, you can survive losing streaks without depleting your account, which is key to long-term success.

Step 6: Develop Emotional Discipline

Forex trading is as much a mental game as a technical one. Fear, greed, and impatience can lead to impulsive decisions. Key practices include:

- Stick to your trading plan and avoid chasing losses.

- Do not overtrade during winning or losing streaks.

- Take breaks to maintain mental clarity.

Emotionally disciplined traders make decisions based on data and analysis rather than gut feelings, significantly improving consistency.

Step 7: Continuously Learn and Adapt

Forex markets are dynamic. Successful traders continuously learn, test, and refine their strategies. Techniques include:

- Maintaining a detailed trading journal of every trade.

- Reviewing trade outcomes weekly or monthly to identify mistakes and successes.

- Exploring new tools, indicators, or strategies as markets evolve.

Adaptation is critical--what works today may not work tomorrow. By staying informed, you position yourself to exploit new opportunities while minimising risks.

Step 8: Choosing a Reliable Forex Broker

Not all brokers are created equal. Selecting a regulated and reputable broker is essential:

- Ensure regulation by a recognised authority (e.g., FCA, CySEC, ASIC).

- Check for competitive spreads, commissions, and fees.

- Test the trading platform for ease of use and reliability.

- Confirm deposit and withdrawal options suit your location.

A trustworthy broker protects your funds, ensures smooth trade execution, and provides the tools needed to implement your strategy effectively.

Step 9: Patience and Consistency Are Key

Many traders fail by expecting overnight success. Consistent profitability requires patience and a long-term mindset:

- Focus on quality setups rather than quantity of trades.

- Gradually increase trading size as your confidence and experience grow.

- Stick to your strategy even during losing streaks--consistency beats impulsive decisions.

Step 10: Advanced Tips for Increasing Consistent Profits

Beyond foundational principles, experienced traders apply advanced techniques to improve results:

1. Correlation Analysis

Understanding correlations between currency pairs helps diversify trades and manage risk. For example, EUR/USD and USD/CHF often move inversely, which can inform hedging strategies.

2. Economic Calendar Monitoring

Track key economic events like NFP (Non-Farm Payroll) releases, interest rate decisions, and central bank announcements. Trading around these events requires caution but can present high-probability opportunities.

3. Automated Trading and Algorithms

For traders comfortable with technology, algorithmic trading can help execute pre-defined strategies consistently without emotional interference. Platforms like MetaTrader 4/5 support Expert Advisors (EAs) to automate trades.

4. Risk-Reward Optimisation

Aim for trades with a favourable risk-reward ratio--typically at least 1:2. This means potential profits are at least twice the amount risked, allowing consistent profitability even with a lower win rate.

5. Position Sizing Based on Volatility

Adjust position size according to market volatility. During high volatility periods, smaller positions reduce the risk of significant losses, while calm markets may allow slightly larger trades.

Step 11: Real-Life Case Study

Consider a trader who started with a $5,000 account. They focused on EUR/USD and GBP/USD pairs, maintained a strict risk management plan (1.5% per trade), and used a combination of technical and fundamental analysis. Over 12 months, by sticking to disciplined strategies and journaling every trade, the trader grew the account steadily to $12,500 without taking excessive risk. This demonstrates that consistent profits are achievable with discipline, education, and patience.

Step 12: Avoid Common Pitfalls

Even experienced traders can fall into traps. Avoid these common mistakes:

- Overleveraging accounts in pursuit of quick profits.

- Ignoring proper risk management techniques.

- Chasing trades without a plan or proper analysis.

- Failing to adapt strategies to changing market conditions.

- Trading while emotionally stressed or distracted.

Step 13: Tools and Resources for Success

Leverage the right tools to enhance trading efficiency and insights:

- Economic calendars for upcoming data releases.

- Technical indicators and charting software.

- News platforms for real-time financial news.

- Trading journals or apps to track performance and decisions.

- Demo accounts for strategy testing and skill refinement.

Step 14: Long-Term Mindset and Continuous Growth

Forex trading is not a get-rich-quick scheme. By focusing on long-term growth, disciplined execution, and continual learning, traders can build sustainable income streams. Start small, track your progress, learn from mistakes, and gradually increase trading size as your skill and confidence improve.

Conclusion: Consistency Is the Key to Making Money With Forex

Making consistent money with Forex trading is achievable for those willing to invest in education, strategy development, risk management, and emotional discipline. By following the steps outlined in this guide, including:

- Educating yourself thoroughly about Forex markets

- Developing a solid, tested trading strategy

- Implementing strict risk and money management practices

- Maintaining emotional discipline and a long-term mindset

- Choosing a reliable and regulated broker

- Adapting continuously and learning from every trade

...traders can navigate the Forex market with confidence and build a path toward consistent profitability. Remember, success in Forex is a journey of patience, discipline, and continuous learning. With the right mindset and strategy, making steady money in Forex is entirely within your reach.

Start your Forex journey today with small, calculated trades, focus on learning, and gradually scale your trading as you gain experience. Use resources like demo accounts , educational articles, and analysis tools to refine your approach and maximise your chances of long-term success.

Recommended for You

You Might Enjoy

How to Improve Google Rankings Fast

Every website owner dreams of seeing their site on the first page of Google. After all, the first…

The Ultimate Guide to Choosing the Perfect Hosting Service Provider

Choosing the Perfect Hosting Service Provider Selecting the right hosting service provider is…

SEO Struggles in 2025: Memes for Every Content Creator

Search Engine Optimisation (SEO) has always been a moving target, but 2025 has introduced a new…More Reads You’ll Love

Importance Of Backlinks

Importance Of Backlinks Today, you'ii learn the importance of backlinks, how to check them for…

optimize website via functions.php file

Optimize Your Website via Functions.php File Optimizing a website through the functions.php file in…

🔥 Best Dating Meme Themes: First Date Awkwardness We All Know Too Well

Dating has always been full of comedy, heartbreak, and unforgettable awkwardness. From the nervous…Other Topics That Might Interest You

Easy SEO Link Building

Martins Free and Easy SEO link building : Boost Your Website's SEO with Genuine Backlinks In this…

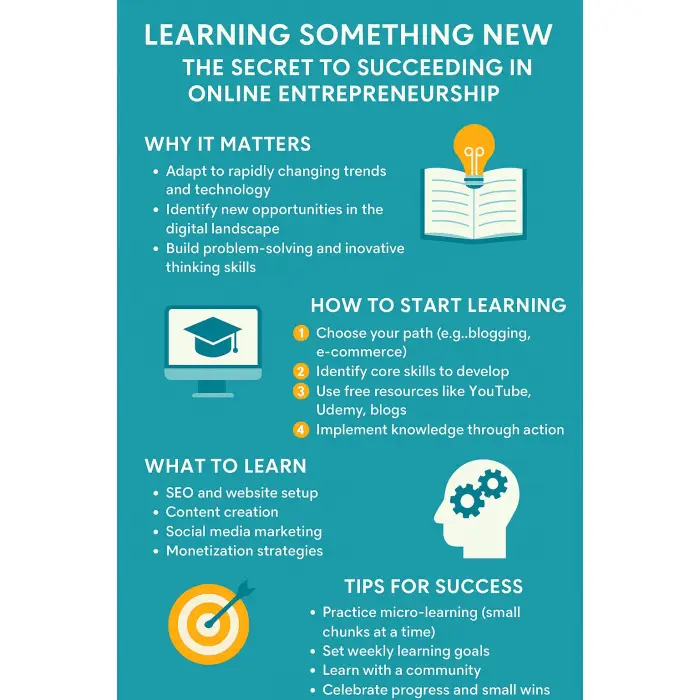

The Secret to Succeeding in Online Entrepreneurship

How to Launch Your Journey into Online Entrepreneurship Embarking on the path of online…

Watercolour Paint for Professionals

Watercolour Paint for Professionals Why use Watercolour Paint for Professionals? Watercolour paint…Traffic Coop Earnings

Ready to Monetise Your Traffic?

Stop letting your visitors slip away without value. With the LeadsLeap Co-op, you can turn every click into income. Join through my link below and I’ll personally share my tips for getting started fast.

🚀 Join My LeadsLeap Co-op Now*Referral disclosure: I may earn a commission when you sign up through this link. There’s no extra cost to you — your support helps keep this site alive.

Comments